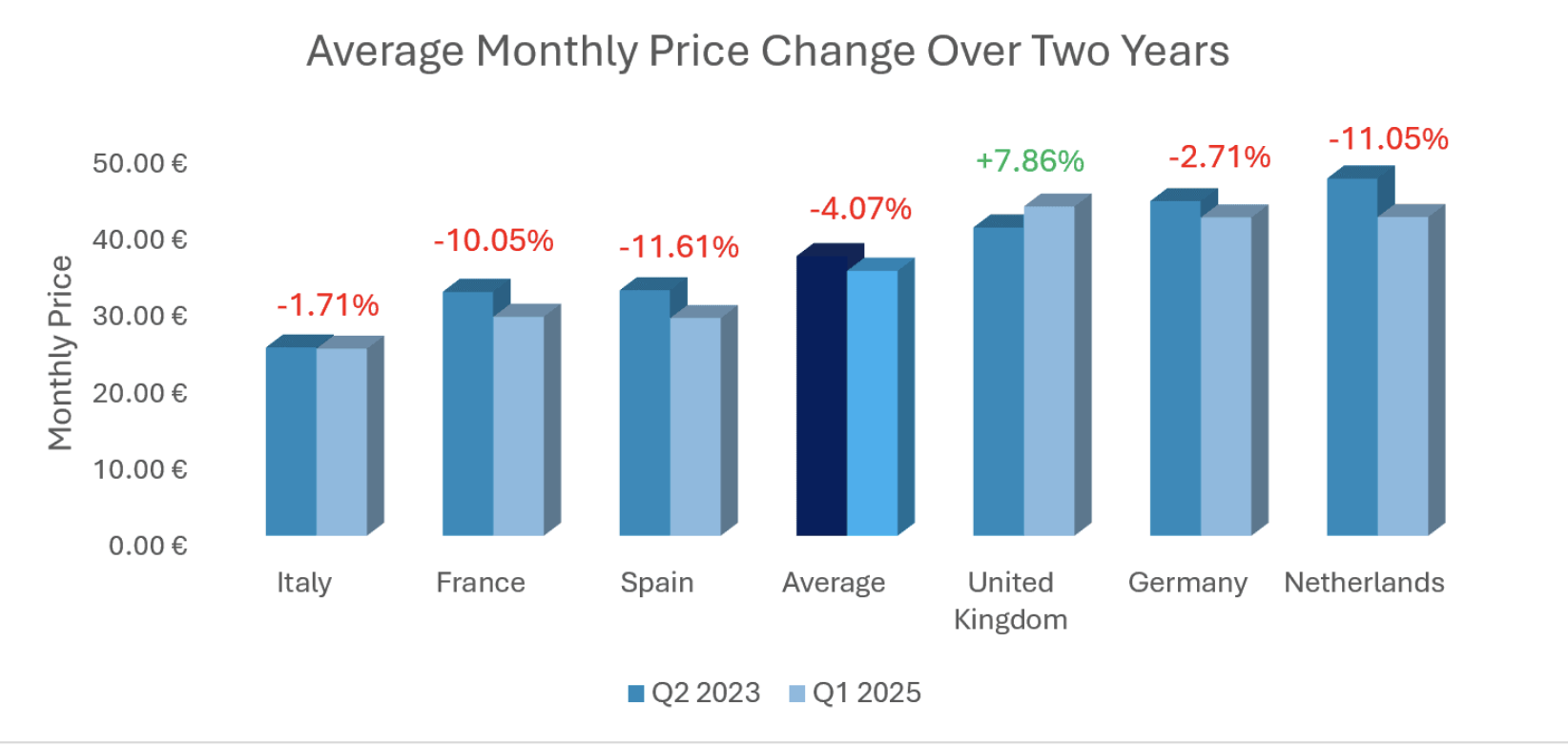

The UK has bucked a broader European trend of falling fixed broadband prices, according to a study from global telecom data specialist Tarifica.

Five out of six major European markets saw broadband prices drop between 2023 and 2025, but the UK experienced an increase, driven by rising costs of ultra-high-speed plans.

Tarifica’s analysis covered France, Italy, Germany, the Netherlands, Spain, and the UK, comparing broadband pricing trends across multiple speed tiers.

The UK, which was already the third most expensive market in 2023, has surged to the top, overtaking Germany and the Netherlands to become the priciest among these key markets by early 2025. Spain, the Netherlands, and France reported double-digit broadband price reductions. Italy remains the most affordable market, while Germany is among the more expensive.

This rise is primarily attributed to a 50 per cent hike in the average cost of plans offering 1000 Mb and above,the segment where consumers demand premium services. Entry-level and mid-tier broadband packages in the UK saw minor price declines, but these were insufficient to offset the impact of high-end price inflation.

The study highlights a gap in the availability of ultra-fast broadband. Eighty per cent of operators in five European countries offer plans of 1000 Mbps or more while these arfe available from 38 per cent of UK providers.

This limited availability, combined with higher prices, presents challenges for UK consumers eager to upgrade to next-generation speeds” says Tarifica.

Infrastructure rollout and fibre network investment hurdles continue to hamper speed expansion.

Will Watts, Vice President of Product at Tarifica, said, “The UK market is experiencing a distinct dynamic. Competition remains robust at lower tiers, but the premium segment is pushing average prices higher. This is a trend not seen in most other European countries. Notably, a leading UK operator still does not offer plans above 250 Mbps, underscoring the uneven landscape for broadband speeds.”.