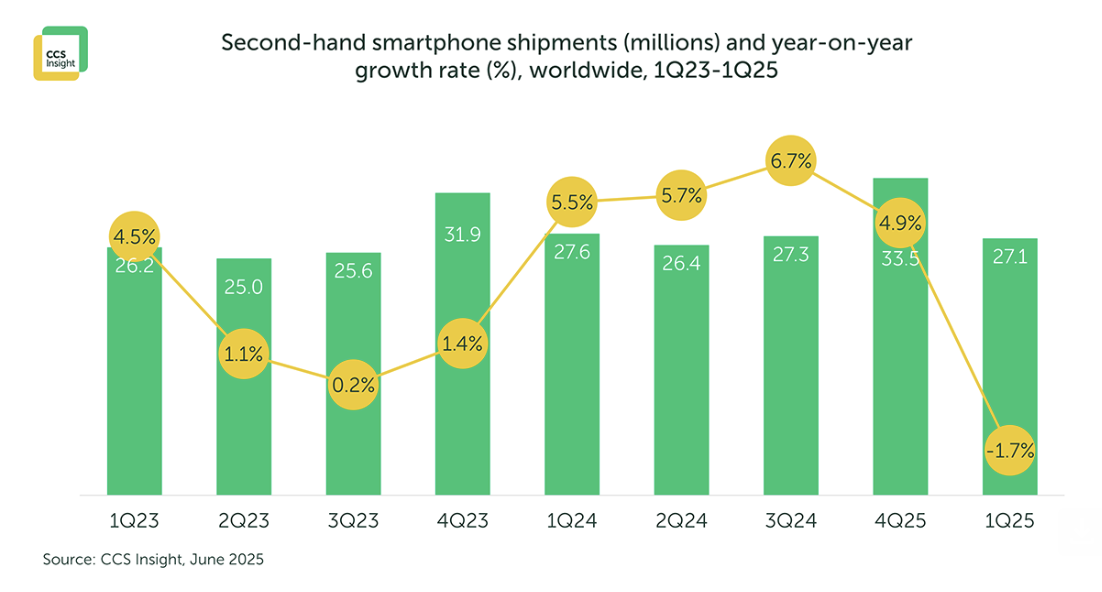

The global secondary smartphone market dipped two per cent in Q1, its first annual drop in more than three years, according to CCS Insight.

The European market followed suit, also registering a two per cent decline during the same period.

The fall in volumes—estimated at 27.1 million units globally—was largely attributed to weak retail footfall and a hangover from aggressive promotional activity in 2024 that pulled demand forward into last year.

Mobile operators were hit especially hard as consumers increasingly opted for SIM-free handsets via online marketplaces and direct-to-consumer brand channels.

Despite the dip, analysts at CCS Insight say the market fundamentals remain strong. They point to growing industry investment in internal trade-in schemes and mounting regulatory pressure as key drivers of recovery for the remainder of the year.

“A combination of lacklustre new device innovation and persistent economic caution has driven more consumers to consider second-hand phones,” said Ben Hatton, Market Analyst at CCS Insight. “This quarter’s decline is a temporary setback. We expect recovery as the year progresses, particularly in mature markets like France and the UK.”

France and the UK both underperformed the European average, falling 11% and 3% respectively. However, Hatton noted these markets will serve as bellwethers for the sector’s strength through the rest of 2025.

Trade-In Programmes

As European players seek to shore up supply in a tightening market, trade-in schemes are emerging as a critical strategy. CCS Insight’s consumer research shows that only 31 per cent of Europeans currently trade in or sell their phones when purchasing a new one, suggesting a major untapped opportunity of up to 100 million devices annually.

“Internal supply is becoming more important as access to imported devices becomes constrained by regulation,” Hatton said. “Companies that can build or enhance in-house trade-in programmes will be better positioned to navigate future shortages.”

The tightening regulatory landscape is also acting as a catalyst for innovation. Forward trade-in programmes—where buyers lock in a guaranteed resale value at the time of purchase—are gaining traction as a way to improve take-back rates and strengthen residual values. Samsung’s Galaxy Club in the UK is cited as a prominent example of this strategy in action.

Simon Bryant, Vice President of Research at CCS Insight, added: “Forward trade-in models not only help secure future device supply but also deepen customer engagement. These programmes are becoming a strategic differentiator, especially as competition in the secondary market heats up and margins tighten.”

With consolidation on the horizon and a push toward scale, the remainder of 2025 is likely to be shaped by how effectively players adapt to supply challenges and regulatory demands—while keeping pace with shifting consumer expectations.

CCS Insight will be presenting further perspective on the secondary market at mobile News Circular Summit. Book here.